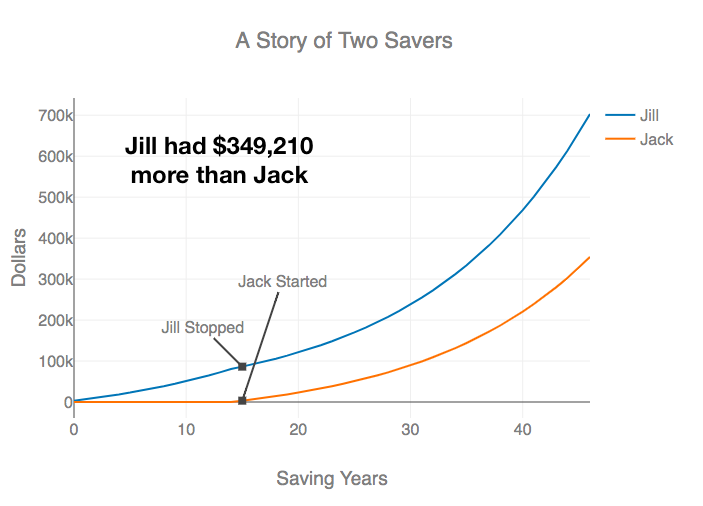

A Story of Two Savers

This is a story of two teachers Jack and Jill. Jack delayed saving for his retirement until he was 37. He thought of his family and future, he began saving every year until he retired at 70. In contrast, Jill began contributing to her retirement when she began teaching, after 15 years she stopped and never saved again until she retired at 70. In total, Jill saved 15 years and Jack saved 33... who do you think had more at retirement?

*This chart is to demonstrate the effects of compound interest. This is not a prediction of any individuals investment performance.

** This graph assumes a fixed 7% interest rate and a yearly investment of $3,000